QX Digital Platform for Asset Managers

QUODD puts Institutional Asset Management at the center of the data consumption experience.

NEW STANDARDS

Agility and Client-Centric

QUODD empowers clients to harness data on demand, setting a new standard for agility and client-centric products. We understand the importance of economic alignment with our customers, offering integrated experiences and multiple on-ramps to ensure easy adoption and frictionless sourcing of our data solutions.

Institutional asset managers face the challenge of ensuring accuracy and timeliness in back and middle office operations while delivering precise market data for superior investment strategies. Maximize your capabilities with our digital platform, providing real-time and end-of-day securities pricing and reference data across all asset classes.

- Ensure easily accessible data at any location in response to the evolving shift in working styles.

- Empower your organization to tailor data access plans according to differing needs and budgets.

- Benefit from automated price verification and tolerance checks, reducing the risk of compliance breaches and the need for extra resources to resolve continuous monitoring pricing failures.

QUODD powers the Institutional Asset Management segment with exceptional customizability, control, operational efficiency, compatibility, and scale. Powered by our proprietary technology and cloud-based infrastructure, we enable customers to source tailor-made data products in formats of their choice, anytime, anywhere.

Together with our flexible pricing model, transparent billing process, and world-class support team, QUODD is putting control back in the hands of data consumers across the end-to-end fulfillment journey.

QX Digital

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis sagittis luctus ex sed laoreet. Sed tempus ligula sit amet neque rhoncus cursus. Aenean non elementum diam.

Data Platform as a Service (DPaaS)

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis sagittis luctus ex sed laoreet. Sed tempus ligula sit amet neque rhoncus cursus. Aenean non elementum diam.

Trusted by

Technology powered

market data ecosystem

We enable our customers to organically evolve their operations and business models without the need for a complex technology integration projects. By offering its data via files, the platform, or programmatic access to APIs with quality and reliability to companies wherever they are on their digital modernization journeys.

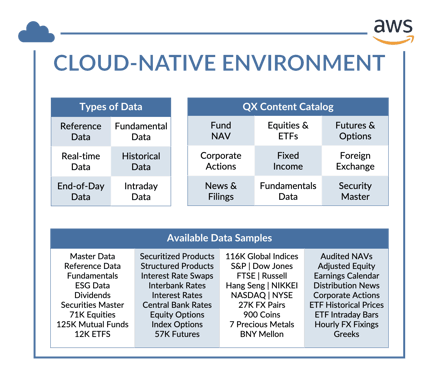

Our technology is a modern cloud-based infrastructure and tooling for the automation, control and consumption of all types of financial market data information. It transforms the consumption of comprehensive market data content, our customers consume what they want and when they need it in the delivery mechanism of their choice.

Technology now powers an ability to absorb new market data elements, maintain various upstream and downstream integration points as well provide the varied frequency required for the financial services ecosystem of today at a reliable and cost-effective rate.

APIs that might interest you

Ready to benefit from a Market data partner that delivers?

Industry Case Studies

04.03.2024

|Market Data

|3 Min Read

The Power of Accurate Daily Fund Accruals (MILS)

Daily fund accruals play a crucial role in the comprehensive management and administration of investment funds, ensuring that investors receive equitable and accurate representations of their holdings’ value on a daily basis.

04.17.2024

|Market Data

|5 Min Read

The Power of Daily Security Master Maintenance

Security master maintenance is an essential component of any wealth management platform. QUODD’s security master solution is utilized across various back-office teams including Asset Setup and Management, Fund Accounting, Valuations, Pricing, and Security Operations.

03.05.2024

|Market Data

|3 Min Read

Transparency and Intelligence: The Power of Price Challenges

QX Digital and the Price Viewer application provide users with simplified access to timely information to better understand the market data inputs that go into the creation of an evaluation.

APIs that might interest you

BATS Exchange Real-Time Stock Quotes API

BATS Real-Time

Delayed U.S. Corporate Bonds Prices API

Bonds

Bond Trades Reported on FINRA TRACE File