Industry Insights

Insights into QUODD and our mission to democratize market data.

03.05.2024

|Market Data

|3 Min Read

Transparency and Intelligence: The Power of Price Challenges

QX Digital and the Price Viewer application provide users with simplified access to timely information to better understand the market data inputs that go into the creation of an evaluation.

03.05.2024

|Market Data

|QX Digital

|3 Min Read

Modern Back Office Workflows for Pricing and Reference Data: The Power that Price Challenges Provide in Transparency and Intelligence

At QUODD, we built our QX Digital Platform to bring this modern experience to our valued clients across the buy and sell sides; spanning operational workflows within banking & trust, asset management, asset servicing (custody/clearing/fund admin), wealth tech solutions, accounting platforms, capital markets, fintech trading/analytics and other segments.

02.21.2024

|Market Data

|QX Digital

|3 Min Read

Modern Back Office Workflows for Pricing and Reference Data: The Power of Daily Price Verification and Tolerance Checks

The industry trend is rapidly moving towards data-on-demand that involves customized delivery models, coupled with a user-specific experience that works better with the workflow needs of middle-and-back-office employees, who are often either fully or partially remote and need immediate fingertip access.

05.16.2023

|Market Data

|3 Min Read

SOFR, ESTR, SONIA, AONIA, CORRA, SORA: The LIBOR Replacements Are Lining Up

Amet minim mollit non deserunt ullamco est sit aliqua dolor do amet sint. Velit officiaL

05.03.2023

|Market Data

|3 Min Read

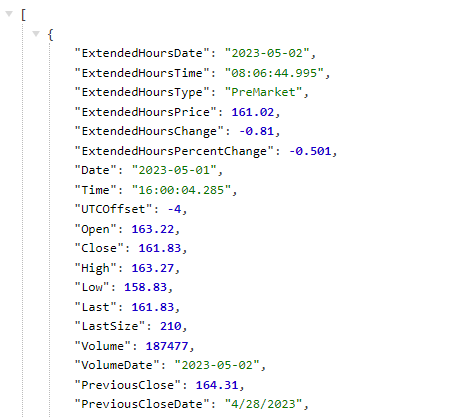

Receive Millisecond-Level Timestamps With Customizable Client Profiles

REST APIs have come a long way in the last 15 years. It used to be that given their inherent latency, use cases were limited to simple display on websites and other applications. As a result, the first generation of APIs only displayed timestamps down to a second-level precision.

04.28.2023

|Market Data

|3 Min Read

Banks are waking up to the hidden risks of market data

A recent analysis from The Everest Group cited in American Banker highlights how shoring up risk management practices has risen to the top of the priority list for bank execs, noting that banks will increase their annual spend on risk technology by 8%-to-12% in the next 12 months. In short, banks understand they need to improve their risk management practices across business lines and functions and are actively making technology-driven efforts to address them.

01.18.2023

|Market Data

|3 Min Read

QUODD Ahead: Technology Forward

The combination of technology costs rising and margins shrinking throughout the financial services industry benefitted QUODD greatly in 2022 as we continued to position ourselves as a cloud-first market data provider that is consistently changing with the way information is consumed in this era of on-demand digital services.

11.29.2022

|Market Data

|3 Min Read

Imagining the Next Generation of the Back Office

The next generation of the back office is going to force the hand of many organizations that have clung to legacy systems, especially when it comes to how these firms access, consume and share market data. The fact is that people remain at the core of the success of any business, financial services notwithstanding. To ignore the realities of what the modern employee now requires to be successful in your organization is to ignore them at your own peril potentially.

10.25.2022

|Market Data

|3 Min Read

Introducing Equity Option Greeks and Implied Volatility API

QUODD, the leading global provider of financial market data APIs, announced the launch of a new Option Greeks and Implied Volatility API. Clients can now easily add Greeks and implied volatility to their platforms to help investors make better option trading decisions.